Published Under: CSE Education Fraud Tips

HOW TO GUIDE: STAYING SAFE FROM AI SCAMS

Artificial Intelligence (AI) is changing the way we live, work, and manage our finances. While AI has many benefits, scammers are also using this technology to create more convincing and sophisticated fraud schemes.

As your trusted credit union, we want to ensure you know how to protect yourself. Follow this step-by-step guide to stay safe!

Step 1: Recognize the Most Common AI Scams

- AI-Generated Voice Scams (Imposter Calls)

Scammers use AI to clone voices and telephone numbers, making it sound and look like someone you know, or even that a financial institution is calling you with an urgent request. - AI-Powered Phishing Emails and Messages

AI allows scammers to craft highly realistic emails, texts, and chat messages impersonating trusted companies, directing you to fake websites designed to steal your credentials. - Deepfake Scams

Deepfake technology enables fraudsters to create fake videos or images that appear to feature real people, such as public figures or family members, to deceive victims. - AI-Assisted Investment and Loan Scams

Scammers use AI to generate fake investment opportunities or loan offers that seem too good to pass up but require upfront fees or access to sensitive personal data.

Step 2: Spot the Red Flags

Be on the lookout for warning signs that may indicate an AI scam:

- Urgency and Pressure: If you're being rushed to act immediately, it’s a red flag.

- Unusual Payment Requests: Be wary of requests for gift cards, cryptocurrency, or wire transfers—these are common scam payment methods.

- Too-Good-To-Be-True Offers: If an investment or loan offer seems overly generous, it likely is a scam.

- Suspicious Email Addresses or Phone Numbers: Check for small misspellings or unusual domains in emails, as well as unknown or masked phone numbers.

- Requests for Personal Information: No legitimate financial institution will ask for your Social Security number, passwords, or PINs via unsolicited messages.

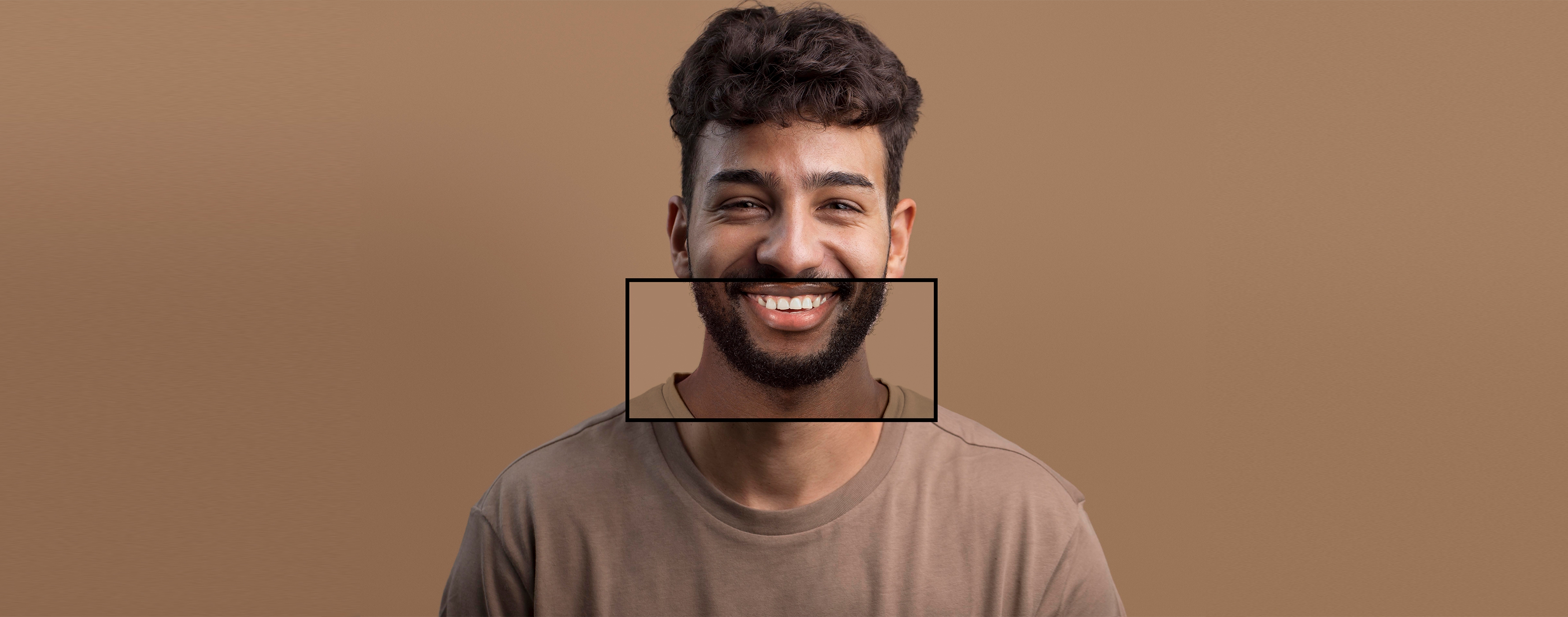

- Revealing Signs that it’s Deepfake: Unnatural Facial Movements or Expressions such as:

- awkward or unnatural blinking

- stiff facial expressions

- delayed reactions

- Lip Syncing Issues

- Blurry or Warped Facial Features such as distortion around the mouth, ears, or eyes, especially when the person turns their head.

Step 3: Take Action to Protect Yourself

- Verify Before You Act: If you receive an urgent request from a loved one or financial institution, call them directly at a known, trusted number to confirm its legitimacy.

- Avoid Clicking Suspicious Links: NEVER click on links or download attachments from unknown sources, as they could contain malware.

- Strengthen Your Security: Use strong, unique passwords for all accounts and enable Multi-Factor Authentication (MFA) for an extra layer of protection.

Step 4: Report Suspected Scams Immediately

If you believe you’ve been targeted by an AI scam, take these steps right away:

- Contact Your Credit Union – Report suspicious activity so we can help protect your accounts.

- Alert Law Enforcement – File a complaint with the Federal Trade Commission (FTC) or your local authorities.

- Warn Others – Sharing your experience helps prevent scams from spreading.

At CSE, we prioritize your financial security. If you ever suspect a scam, don’t hesitate to reach out. Together, we can stay ahead of fraudsters and keep your finances safe!

Comments