February 25, 2026

Buying a Vehicle in 2026: What to Know Before You Hit the Lot

Read Full Post

February 25, 2026

Buying a Vehicle in 2026: What to Know Before You Hit the Lot

Read Full Post

The Future of Retirement: Planning for 2050, 60, or 70 (Yes, Starting in 2026)

Read Full Post

August 6, 2025

How-to-Guide: Building Credit for Gen Z—A Real-World Guide to Getting Started For many Gen Z-ers, building credit can feel like one of those “adulting” tasks that you should be doing, but for many, no one really explains how crucial credit is for your financial future! Whether you're dreaming of renting your first apartment,

Read Full Post

How to Guide on Preparing for Tax Season The New Year is here, and that also means the countdown to tax season begins. Preparing your taxes may seem like a stressful and daunting task, but it doesn’t have to be. With a little organization and planning, you can file your taxes efficiently and even uncover opportunities to save money. Step...

Read Full Post

December 18, 2024

Season’s Greetings from Your Credit Union! As we celebrate the close of 2024, we’re reflecting with gratitude on a year of growth and renewed commitment to our members and community. Thanks to our expanded field of membership, to now include Stark, Summit, Portage, Tuscarawas and Carroll counties, we’ve had the privilege...

Read Full Post

December 4, 2024

Recap & Refresh – CSE Blog Wrap-Up As another year ends, we’re thrilled to recap our 2024 journey through financial education! Together through our blog, we explored a variety of money topics, from budgeting basics to protecting against scams and fraud. Here’s a quick guide to all the topics we covered this year in our...

Read Full Post

Helping Your Elderly Parents Manage Their Money As our parents age, there may become a time when managing their money becomes a difficult task for them. If you’re the designated helper when it comes to their money, here are ten tips on how you can help ensure they remain secure and comfortable. #1 OPEN COMMUNICATION Starting...

Read Full Post

September 1, 2024

The Rise of Fraud and AI: How to Protect Yourself & Your Money Technology is evolving as fast as you can blink your eye. One of the most significant challenges we face with this fast-paced evolution of technology is extremely sophisticated and highly believable fraud schemes, many of which are powered by advancements in artificial intelligence...

Read Full Post

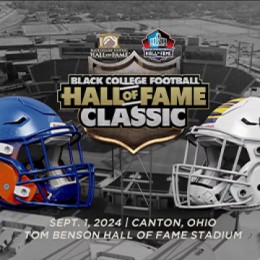

Let's BOGO! Special BOGO Ticket Offer for CSE Members! Join us for the Black College Football Hall of Fame Classic Weekend! We are proud to partner with the Pro Football Hall of Fame to celebrate the upcoming Black College Football Hall of Fame Classic weekend. Saturday, August 31: Join us at Centennial Plaza as we present the HBCU Family Block

Read Full Post

August 5, 2024

Financial Glossary for Kids Broken Down by Age Teaching your kids how to manage their money is a life skill they’ll always use. Raising your children with the knowledge of how they can earn, save, and budget money will give them a head start to be prepared for the real world. It all starts with helping them understand some of these...

Read Full Post